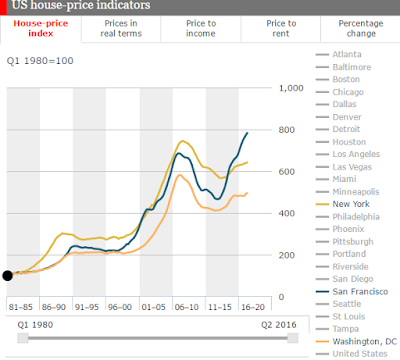

UNITED STATES HOUSE PRICE INDEX

|

UNITED STATES HOUSING PRICES IN REAL TERMS |

The latest data from economist explains, the state of frothiness and uncertainty of US Housing market. Despite efforts to fix the American housing mortgage market, housing in the United States still remains a dangerous in terms of disrupting the world economy.As property prices in the united states underpinned by low interest rates, forge ahead,however on average, American home prices have recovered nearly all their losses from the 2006 crash, but when adjusted for inflation they are still 20% below the 2006 peak. explains the chart.

.Also the construction of new homes remains lukewarm.The rate at which homebuilders are constructing new single family homes remains quite depressed, despite steadily increasing demand. Those in the business have argued that demand and supply-side factors, like increased regulation & ashort supply of skilled labor as reasons they have been slow to meet demand.The Homes Being Built are Mostly for the High End of the US Housing Market.

.Also the construction of new homes remains lukewarm.The rate at which homebuilders are constructing new single family homes remains quite depressed, despite steadily increasing demand. Those in the business have argued that demand and supply-side factors, like increased regulation & ashort supply of skilled labor as reasons they have been slow to meet demand.The Homes Being Built are Mostly for the High End of the US Housing Market.

Another roadblock for prospective home owners is that "lack of credit".This also means that The lack of credit available for new homebuyers has forced more and more homeowners into the rental market, driving up rents and put further pressure on already strained middle-class budgets.The mean modal age in America is 26, and this echo-boom generation has yet to settle down and seriously consider home buying and home ownership. Analysts hope that this new demographic wave will provide a jolt and a shot in the arm to the the housing sector back into pre-bubble normalcy

To gauge the frothiness of America’s housing market, The Economist looks at two measures of affordability:1) The ratio of price to income and 2) price to rent. Encouragingly, across America prices appear to be at fair value when compared to their long-run averages. Yet in some cities, such as San Francisco, affordability looks stretched when compared against income—prices in the City by the Bay are 40% above their long-run average when compared to income. Theory suggests that they should eventually fall back down to earth. |

No comments:

Post a Comment