|

| Biggest Chinese Firms Buying out Foreign Companies |

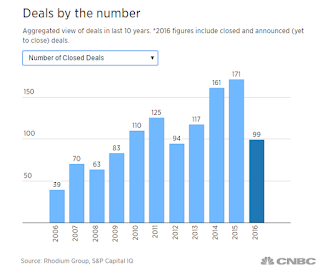

According to Dealogic data, Outbound M&A spending took a total of $90.6 billion out of China in 2015.Meanwhile the 10 (mostly state-owned) Chinese companies that spent the most money buying foreign businesses last year did $46.6 billion in deals, representing between 5 and 10% of the capital that left China’s borders. |

No comments:

Post a Comment