President elect Donald Trump has a tough job on this hands. Generating jobs which remains his is principle mandate and the biggest reason he feels he has been elected for will be an enormous challenge specially in the US auto sector. By threatening to levy additional tariffs on cars produced in Mexico, Trump is calling for US car makers to continue to manufacture in United States. However as a recent bloomberg story shows it may be more free trade, not tariffs, that would help the U.S. keep some factory jobs from moving south.

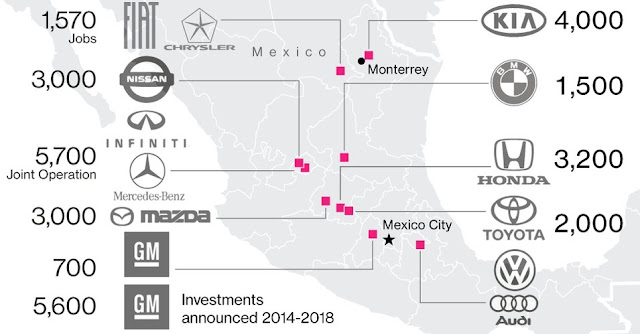

Over the past five years, automakers have rushed to build factories in Mexico. The largest car companies have announced at least $22 billion in investments and about 25,000 jobs at new or expanded plants in Mexico by 2019. And that’s just the jobs that have been made public.

So what do US car makers actually gain to have manufacturing shipped off to mexico before being shipped to be sold to United States ?. Here are 3 reasons why "US car makers are more favorably disposed to Mexico and rather build and manufacture cars there compared to US"

1) Cost of Labor :Cheaper labor is only one reason Mexico has seen a surge in new-car production. While the country’s low wages have been the big attraction, one of its key advantages is that it has is trade agreements.

2)Trade Agreements : Mexico has trade agreements with 44 countries, giving automakers access to half the global car market tariff-free.The U.S. has similar trade deals with just 20 countries, which make up 9% of global car sales, according to the Center for Automotive Research in Ann Arbor, Michigan."It’s pretty ironic that what makes Mexico successful is free trade," said Kristen Dziczek, an analyst at CAR "You can look at the new investment that has gone into Mexico and while a huge portion is for the U.S., they are selling a lot elsewhere, too."

3)Cost Arbitrage :To get a better sense of Mexico’s advantage, consider a $25,000 midsize sedan built and shipped in Mexico with one in the U.S. Automakers can pay.Total hourly compensation in the motor vehicle manufacturing sector is about 80 percent less for Mexican workers compared with that for U.S. workers. Considering assembly time for a typical midsize car, an automaker can save $600 per vehicle on labor costs.( see chart above)

While Infrastructure in Mexico lags behind the highway and rail network in the U.S., so it actually costs automakers $300 more per car in additional shipping expenses to produce the vehicle in Mexico and ship it to Europe, and an extra $900 to ship it to the U.S. That means, even after paying significantly less on labor, a car company is walking away with wage savings of only $300 per car,compared to it being manufactured in the US

Most importantly the bulk of the savings are tied to Mexico’s trade agreements and cheaper parts.Consider this! Automakers can save $1,500 per car on cheaper Mexican auto parts. Certainly, a lot of those savings are tied to the lower wages workers in Mexico are paid. But some of these parts are imported to Mexico tariff-free from countries in Europe and Asia, particularly for the foreign automakers who are increasingly investing in Mexico instead of the U.S. Since the U.S. doesn’t have as many free trade agreements, some of the automakers need would pay extra for some of those parts if they made those models in the U.S which significantly increase the cost of production of cars in United States.

Over the past five years, automakers have rushed to build factories in Mexico. The largest car companies have announced at least $22 billion in investments and about 25,000 jobs at new or expanded plants in Mexico by 2019. And that’s just the jobs that have been made public.

So what do US car makers actually gain to have manufacturing shipped off to mexico before being shipped to be sold to United States ?. Here are 3 reasons why "US car makers are more favorably disposed to Mexico and rather build and manufacture cars there compared to US"

1) Cost of Labor :Cheaper labor is only one reason Mexico has seen a surge in new-car production. While the country’s low wages have been the big attraction, one of its key advantages is that it has is trade agreements.

2)Trade Agreements : Mexico has trade agreements with 44 countries, giving automakers access to half the global car market tariff-free.The U.S. has similar trade deals with just 20 countries, which make up 9% of global car sales, according to the Center for Automotive Research in Ann Arbor, Michigan."It’s pretty ironic that what makes Mexico successful is free trade," said Kristen Dziczek, an analyst at CAR "You can look at the new investment that has gone into Mexico and while a huge portion is for the U.S., they are selling a lot elsewhere, too."

3)Cost Arbitrage :To get a better sense of Mexico’s advantage, consider a $25,000 midsize sedan built and shipped in Mexico with one in the U.S. Automakers can pay.Total hourly compensation in the motor vehicle manufacturing sector is about 80 percent less for Mexican workers compared with that for U.S. workers. Considering assembly time for a typical midsize car, an automaker can save $600 per vehicle on labor costs.( see chart above)

While Infrastructure in Mexico lags behind the highway and rail network in the U.S., so it actually costs automakers $300 more per car in additional shipping expenses to produce the vehicle in Mexico and ship it to Europe, and an extra $900 to ship it to the U.S. That means, even after paying significantly less on labor, a car company is walking away with wage savings of only $300 per car,compared to it being manufactured in the US

Most importantly the bulk of the savings are tied to Mexico’s trade agreements and cheaper parts.Consider this! Automakers can save $1,500 per car on cheaper Mexican auto parts. Certainly, a lot of those savings are tied to the lower wages workers in Mexico are paid. But some of these parts are imported to Mexico tariff-free from countries in Europe and Asia, particularly for the foreign automakers who are increasingly investing in Mexico instead of the U.S. Since the U.S. doesn’t have as many free trade agreements, some of the automakers need would pay extra for some of those parts if they made those models in the U.S which significantly increase the cost of production of cars in United States.

No comments:

Post a Comment